Budgets are prepared following a process that begins with a sales (or revenue) forecast. The example operating budget presented here is of a merchandising company. All businesses need a cash budget, which is the topic of the next section of this chapter. For a service firm, a purchase budget for inventory would not be necessary, but an operating budget would be. The sales budget impacts what needs to be produced (production budget), and the production budget influences planned purchases of material (purchases budget), overhead resources (overhead budget), and the amount of labor costs for the year ahead (direct labor budget.)įor a merchant (such as a wholesaler or retailer), the annual budget would be less complex than that of a manufacturing firm but would still require an inventory purchases budget and an operating expense budget (such as selling and administrative expenses). Take the example of a production budget of a manufacturer. The sales budget is prepared first and has an impact on many other budgets.

#MINIMUM CASH BALANCE FORECASTING SERIES#

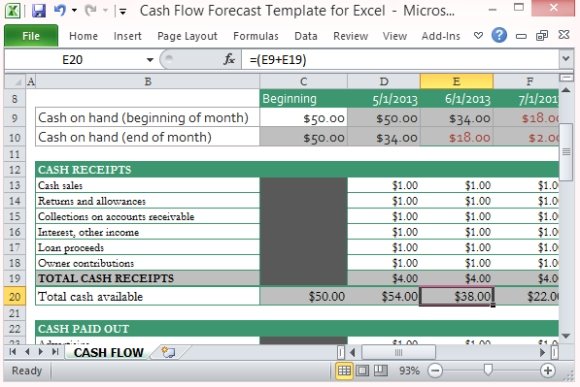

In essence, a company budget is a series of budgets, many of which are interrelated. Preparing an annual operating budget can be a complex task. Sample One-Year (Annual) Operating Budget For example, if in your budget January is the first month of the planning period, once January is over, next January’s cash budget column would be added-right after December’s column (at the far right of the budget). When one month ends, another month is added to the end (the next column) of the budget. A rolling budget changes often as the planning period (e.g., a fiscal year) plays out. New economic forecasts and even cost-cutting measures will require a revision of the cash budget.Īlthough a budget might be prepared for each month of a future 12-month period, such as the upcoming fiscal year, a rolling budget is often used. Changes in any of the “upstream” budgets-budgets that are prepared before the cash budget, such as the sales, purchases, and production budgets-may need to be revised because of changing assumptions. plan for borrowings on lines of credit and short-term loans that might be needed to balance the cash budget.Ī cash budget is a model that often goes through several iterations before managers can approve it as the plan going forward.analyze if planned collections and disbursements policies and procedures result in adequate cash balances and.allocate dollars for contingencies and emergencies.Just as you might budget your earnings (salary, business income, investment income, etc.) to see if you will be able to cover your expected living expenses and planned savings amounts, to be successful and to increase the odds that sufficient cash will be available in the months ahead, financial managers prepare cash budgets to For example, in a manufacturing company, a series of budgets such as those for sales, production, purchases, materials, overhead, selling and administrative costs, and planned capital expenditures would need to be prepared before cash needs (cash budget) can be predicted. The budgeting process of a company is a really an integrated process-it links a series of budgets together so that company objectives can be achieved. It projects the cash flows into and out of the company.

The cash budget, like any other budget, looks to the future.

By the end of this section, you will be able to:Ī cash budget is a tool of cash management and therefore assists financial managers in the planning and control of a critical asset.

0 kommentar(er)

0 kommentar(er)